are delinquent property taxes public record

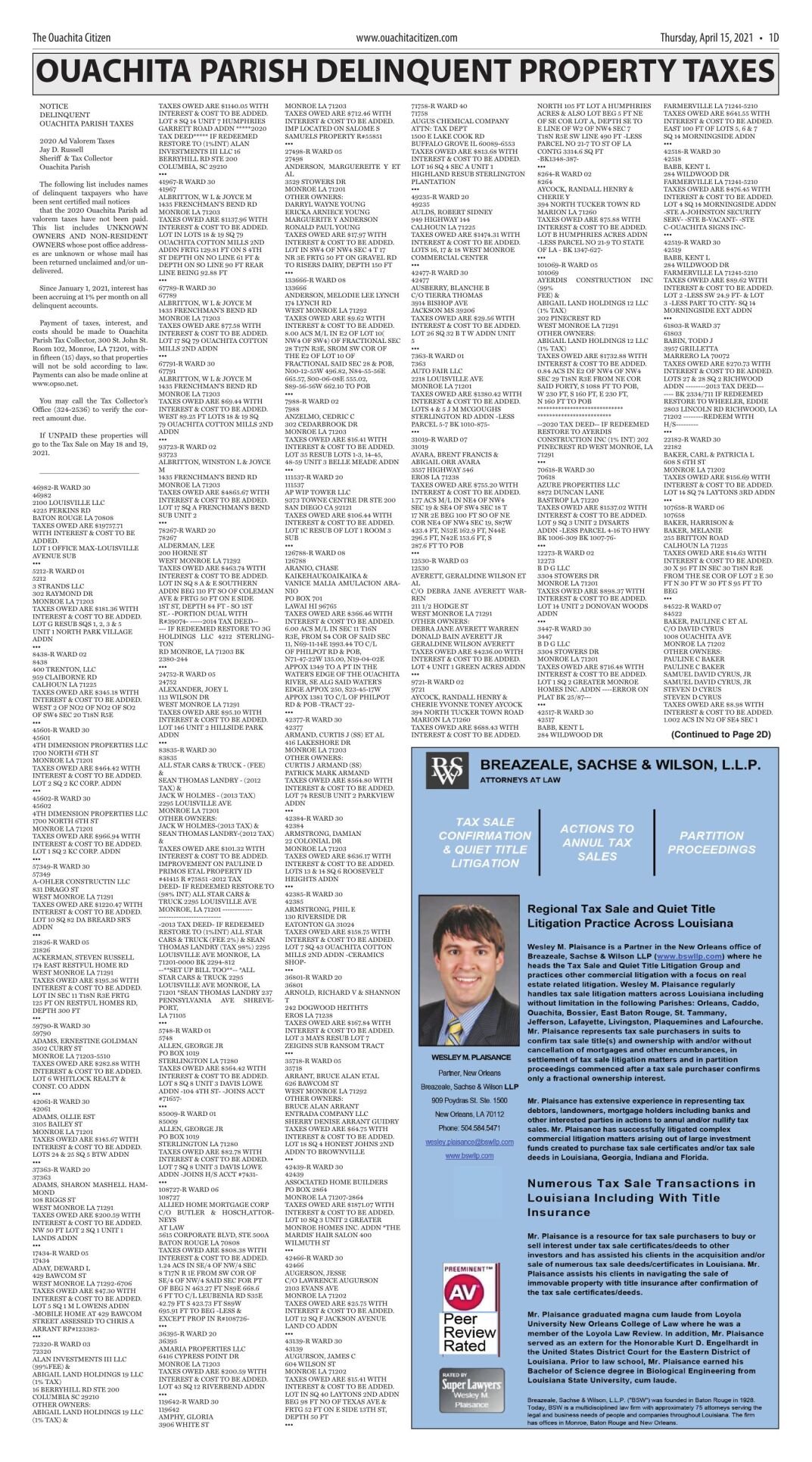

Delinquent Property Tax Search. The real estate that is subject to the lien is listed in the name of the record owner as of the date the taxes became delinquent and the principle amount of the taxes is set out in the advertisement below.

Secured Property Taxes Treasurer Tax Collector

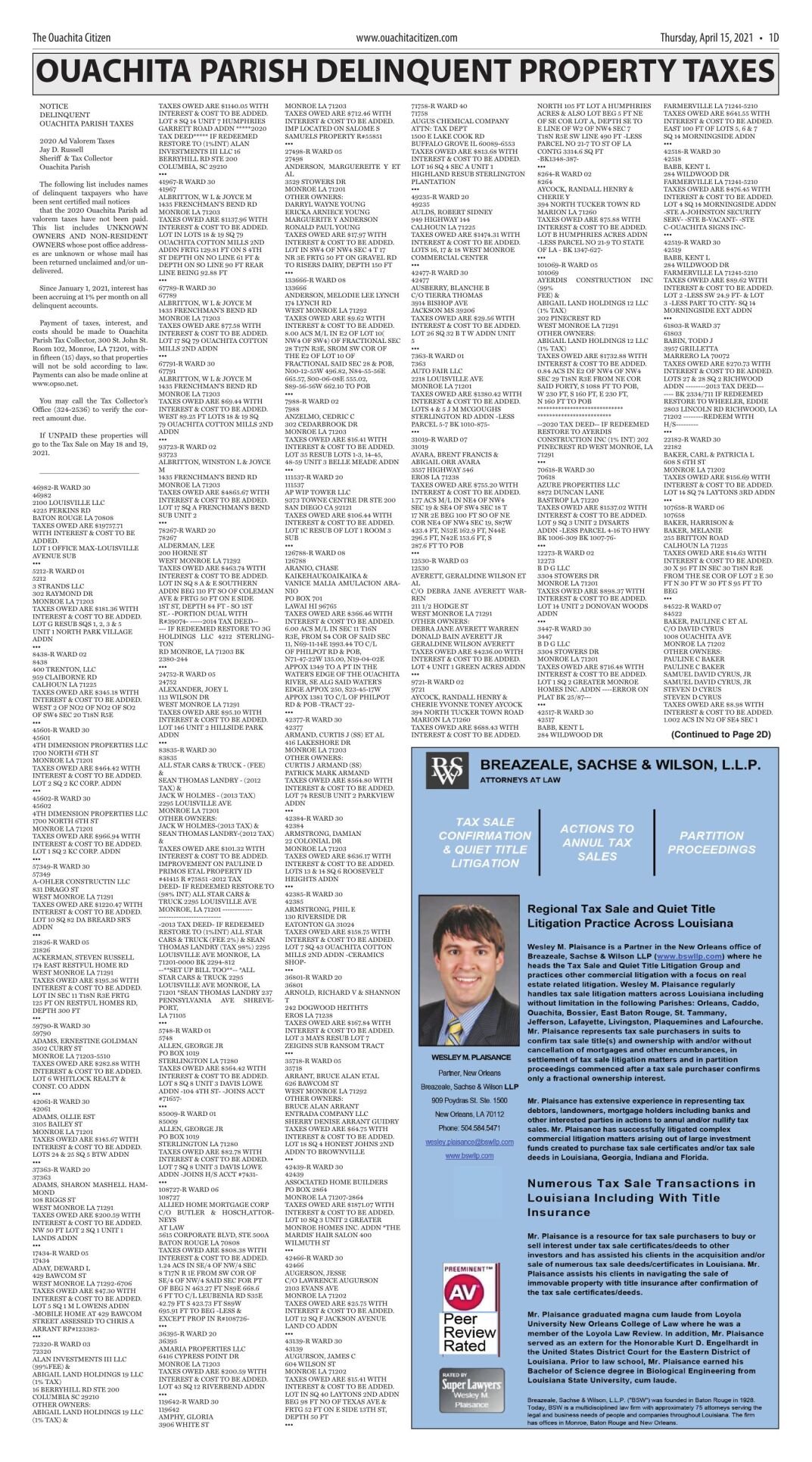

When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property.

. If the taxes remain unpaid the taxing unit will foreclose the tax liens and sell the property subject to the liens in satisfaction of its. Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants. Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself.

The amount due on each parcel includes costs associated with the sale interest prorated advertising as well as taxes and non-ad valorem assessments. The taxes remain unpaid one year after the last date on which they could have been paid without interest. The information displayed reflects the.

Prior to current year delinquent taxes being put in the delinquent records of the County Treasurer they are published in a county newspaper of general circulation for 3 consecutive weeks in August in accordance with the provisions of KSA. Free Oakland County Michigan Delinquent Property Taxes Public Records. If left unpaid the liens are sold at auctions to the public.

Please submit a REAL PROPERTY REFUND REQUEST INQUIRY FORM to report any errors in the property records or to submit questions or comments for the Fiscal Officer. Publication of Delinquent Real Estate Taxes. The property owner may retain the property by redeeming the tax deed application any time before the property is sold at public auction.

All real property that includes public utility tangible personal property delinquencies for these categories are not separated. New York State delinquent taxpayers. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for.

9 am4 pm Monday through Friday. Three categories of delinquent taxes are presented. Seminole County Tax Collector PO Box 630 Sanford FL 32772-0630 407 665-1000 Email Contacts Email Public Records Custodian.

Delinquent Taxes and Tax Foreclosure Auctions. Publication of Delinquent Personal Property Taxes. Delinquent Taxpayer Publication - This publication lists delinquent taxpayers with prior year delinquent taxes.

Contact for View the Public Disclosure Tax Delinquents List. To View ALL Notices CLICK the Search RE Button. In other words if delinquent property taxes are paid off while property is in a tax deed application status the applicant is reimbursed for their total investment accrued interest and the tax deed sale.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Search official records of delinquent property taxes.

It includes all property taxes reported as unpaid in tax year 2020 including taxes that became delinquent in preceding years which were still unpaid in 2020. Eventually the lien owners may have to force foreclosure on the property to pay the liens. In each of the examples above the county could initiate foreclosure against the real property in question after the taxes become delinquent on January 6.

It includes all property taxes reported as unpaid in tax year 2019 including taxes that became delinquent in preceding years which were still unpaid in 2019. Property taxes are considered delinquent for purposes of this program under either of the following circumstances. Three categories of delinquent taxes are presented.

LINN COUNTY DELINQUENT PROPERTY TAX LIST Published in the Mount Vernon-Lisbon Sun Marion Times and Linn News-Letter May 29-31 2018 DELINQUENT REAL ESTATE TAXES I Sharon K. Top 100 Delinquent Taxpayer - This lists the top 100 delinquent taxpayers for the current fiscal year. Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes.

The Lubbock Central Appraisal District reserves the right to make changes at any time without notice. View Albany County delinquent tax lists that are pending property foreclosure auctions. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

We may have filed the warrants over a period of years but we filed at least one warrant within the last 12 months. 145 Jefferson St Camden AR 71701. All real property that includes public utility tangible personal property delinquencies for these categories are not separated.

112 State Street Room 800 Albany NY 12207. By using this application you assume all risks arising out of or associated with access to these pages including. Phone 870837-2240 Fax 870837-2242.

At that point you could take possession of. Original records may differ from the information on these pages. Property information may be obtained by visiting the following pages.

Gonzalez Treasurer of Linn County Iowa hereby give notice that on Monday the 18th of June 2018 at the Nine OClock in the forenoon at Jean Oxley Public Service Center I will. Welcome to the Cuyahoga County Property Information Web site. For example for 2022 STAR benefits the town and county taxes that were due on January 31 2021 have not been paid by.

Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Verification of information on source documents is recommended. Delinquent tax records are handled differently by state.

View the tax delinquents list online. Search Ouachita County property tax and assessment records by name parcel number property id address or subdivision. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor.

Our property records tool can return a variety of information about your property that affect your property tax.

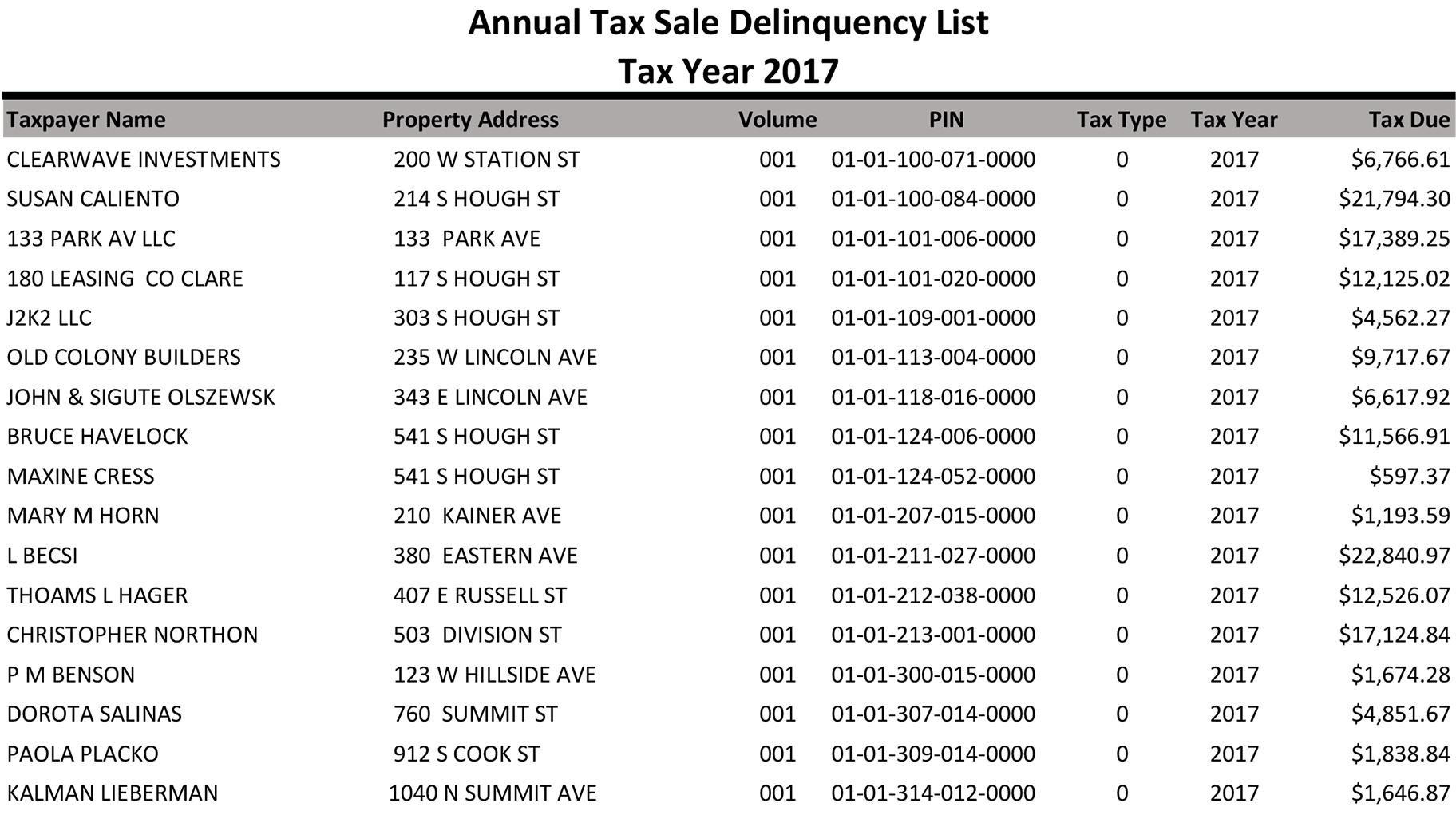

How To Find Tax Delinquent Properties In Your Area Rethority

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know

What Happens If You Don T Pay Property Tax Canada Cubetoronto Com

Pin By Amy Craft On Realtor Need To Know Real Estate Business Homeowner Property Tax

Cook County To Sell Off Tax Delinquent Properties To Highest Bidders Chicago News Wttw

2020 Lucas County Auditor Delinquent Land Tax Notices The Blade

Delinquent Property Taxes April 15 2021 Click To Download Pages Public Notices Hannapub Com

Notice Of Delinquency Los Angeles County Property Tax Portal

Property Taxes And Payment Options City Of Sarnia

Why Posting Delinquent Tax Notices Works Palmetto Posting

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

How To Find Tax Delinquent Properties In Your Area Rethority

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

How To Find Tax Delinquent Properties In Your Area Rethority

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

How To Find Tax Delinquent Properties In Your Area Rethority